Singapore's Executive Condominiums (ECs) are a hybrid housing option designed for middle-income families and those transitioning from public to private housing. First introduced in the early '90s, ECs offer a blend of luxury amenities such as fitness centers and swimming pools with affordability, thanks to government subsidies and grants. They cater to evolving needs, with adjustments in eligibility criteria over time to remain relevant. Today, ECs are sought after for their resilience, adaptability, and affordability, featuring modern smart home technologies and sustainable designs. Prospective buyers must meet specific criteria, including income ceilings and property ownership restrictions, which align with Singapore's long-term housing strategy. The resale value of these units is also notable. ECs are recognized for their strategic placement near transport hubs and as a long-term living solution that reflects the aspirations of Singapore's middle-income families. For financial planning, potential buyers should consider grants like the CPF Housing Grant (CHG), diverse loan options from MAS and financial institutions, and the use of CPF savings, all of which are integral to the affordable investment in an EC. Understanding the eligibility requirements and financial landscape is crucial for those considering an EC as a home in Singapore's dynamic property market.

Executive Condominiums (ECs) in Singapore present a unique blend of private property perks with public housing benefits, making them an attractive option for aspiring homeowners. This article delves into the origins and trajectory of ECs within the nation’s dynamic housing landscape, shedding light on their evolution and current status. From understanding the eligibility criteria that define who can purchase an EC to exploring the financial considerations, including cost, loan options, and CPF usage, this guide offers comprehensive insights into the advantages of choosing an EC over traditional HDB flats in Singapore. Whether you’re a first-time buyer or considering upgrading your home, the information provided will equip you with the knowledge to make informed decisions about this versatile housing option.

- Understanding the Genesis of Executive Condominiums (ECs) in Singapore

- The Evolution and Current Status of ECs in Singapore's Housing Market

- Eligibility Criteria: Who Can Buy an Executive Condo in Singapore?

- The Benefits of Living in an Executive Condo vs. Traditional HDB Flats

- Navigating the Financial Aspects: Cost, Loan Options, and CPF Usage for ECs in Singapore

Understanding the Genesis of Executive Condominiums (ECs) in Singapore

In the context of Singapore’s vibrant property market, Executive Condominiums (ECs) occupy a unique niche that caters to the aspirations of both young families and upgrading residents. The genesis of ECs dates back to the early 1990s when the Singapore government introduced this hybrid housing scheme as an alternative for couples who could not afford private condominiums but had the financial capacity to upgrade from public housing. These residences combine the benefits of a private condo, such as pools, gyms, and other luxury amenities, with the affordability and subsidies available to public housing residents. Over time, ECs have evolved, reflecting the changing demographics and housing needs within Singapore. The eligibility criteria for purchasing an EC have been refined, and the resale value of these units has become a significant consideration for prospective buyers. Today, ECs in Singapore continue to be a popular choice for many, offering a stepping stone towards owning a private property while providing the community and lifestyle benefits akin to those found in more exclusive condominium developments. Prospective residents interested in Singapore ECs should familiarize themselves with the current eligibility requirements, which include limits on income ceilings and the ownership of additional properties. Understanding these factors is crucial for any individual or family considering an EC as their home, as it aligns with the long-term housing goals set by the government’s masterplan for a sustainable living environment in Singapore.

The Evolution and Current Status of ECs in Singapore's Housing Market

In Singapore, Executive Condos (ECs) have undergone a significant evolution in their role within the housing market, reflecting broader societal and economic shifts. Initially introduced as part of the public-private partnership to offer more affordable options for middle-income families, ECs have become an integral component of Singapore’s diverse housing landscape. Over the years, the eligibility criteria for purchasing an EC have been refined, including changes in the income ceiling and housing grants available to eligible applicants. Today, Singapore ECs continue to cater to the needs of young couples and families, providing a stepping stone towards ownership in a vibrant and connected community. With a blend of amenities and proximity to key transport nodes, these condos offer a balanced living option that aligns with the changing demographics and housing preferences in the region.

The current status of ECs in Singapore’s housing market is one of resilience and adaptability. Despite economic fluctuations, the demand for ECs remains robust due to their affordability and strategic location. The Singapore EC landscape is marked by a continuous evolution to meet the needs of residents, with new developments often incorporating smart home features and sustainable design principles. Policies such as the resale leases and upgrading schemes further ensure that ECs remain an attractive and viable housing option for many. As a result, Singapore ECs have established themselves not just as a stepping stone but as a tenure-in-the-balance, offering a sustainable living solution that resonates with the aspirations of middle-income families in Singapore.

Eligibility Criteria: Who Can Buy an Executive Condo in Singapore?

In Singapore, Executive Condominiums (ECs) offer a housing option that caters to the needs of both singles and families, bridging the gap between public and private housing. To be eligible to purchase an EC, potential buyers must meet specific criteria set by the Housing & Development Board (HDB). For example, an applicant must be a Singapore citizen, at least 21 years old, and cannot own or have disposed of another flat after March 31, 2021. Additionally, applicants’ monthly household income should not exceed S$14,000. Couples in which at least one party is a first-timer are given priority when applying for an EC. The definition of a first-timer varies; it could mean individuals who have never owned a flat before, or couples where at least one person has not previously owned a flat. Prospective buyers should also note that they must intends to occupy the flat for a minimum of 5 years upon purchase. These conditions are subject to change, and interested parties should refer to the latest guidelines from the SingaporeEC website or consult HDB resources for the most current eligibility criteria. Understanding these requirements is crucial for individuals looking to invest in an Executive Condo in Singapore’s vibrant real estate market.

The Benefits of Living in an Executive Condo vs. Traditional HDB Flats

Living in an Executive Condominium (EC) in Singapore offers a unique blend of private and public housing benefits that differ from traditional HDB flats. ECs are hybrid homes designed for the needs of upgrading families, providing larger living spaces and superior fittings compared to HDB flats. Residents enjoy the luxury of condo facilities such as swimming pools, gyms, and function rooms, which are not typically available in HDB estates. This enhancement in lifestyle comes with the added advantage of affordability, as ECs are more cost-effective than private condos, making them an attractive option for young couples and families looking to make their first property purchase together.

Moreover, Singapore EC residents benefit from proximity to various amenities and services, similar to HDB flats, but with the added convenience of being nestled within gated communities that offer security and privacy. These residences are strategically located close to shopping centers, schools, and transport nodes, ensuring a convenient and balanced lifestyle. The transition from an HDB flat to an EC also represents an upward mobility milestone for many residents, as these properties are designed to cater to the needs of growing families while allowing them to retain the sense of community found in public housing.

Navigating the Financial Aspects: Cost, Loan Options, and CPF Usage for ECs in Singapore

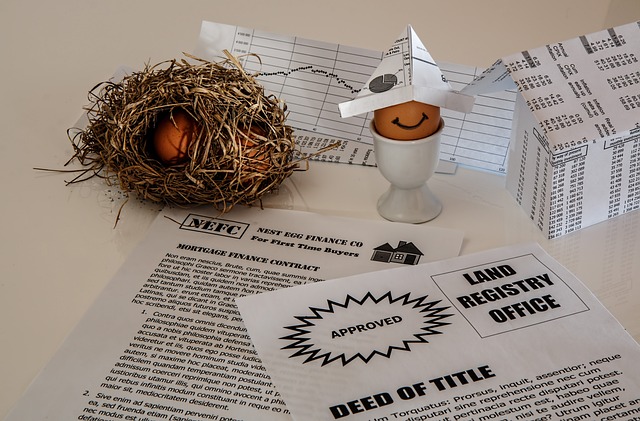

In Singapore, Executive Condos (ECs) present a unique housing option for eligible couples and families seeking a stepping stone to private property ownership. Navigating the financial aspects of purchasing an EC is pivotal for prospective buyers. The cost of an EC in Singapore is influenced by various factors, including its location, amenities, and market demand. Prospective owners must consider the overall price range to determine if an EC fits their budget. Fortunately, financial support is available through government grants such as the CPF Housing Grant (CHG), which can significantly subsidize the purchase of an EC for eligible applicants.

In terms of financing, buyers have several loan options to explore. The Monetary Authority of Singapore (MAS) and financial institutions offer a variety of mortgage products tailored to cater to different financial situations. Additionally, the use of Central Provident Fund (CPF) savings is a common practice among Singaporeans for EC purchases. CPF funds can be used for the downpayment as well as the monthly mortgage installments, making homeownership more accessible. It’s advisable to consult with a financial advisor or the CPF Board to understand the specific usage limits and conditions associated with using CPF savings for an EC. This will ensure that buyers make informed decisions and optimize their financial planning for this significant investment in Singapore EC living.

When considering the journey of securing a home in Singapore, understanding the nuances of Executive Condos (ECs) is pivotal. From their inception to their current role as a stepping stone between public and private housing, ECs like those in Fernvale Lane or Parc Canberra have carved out a significant niche within the nation’s diverse living options. Prospective homeowners must grasp the eligibility criteria that govern who can buy into these properties, as well as the financial implications, which offer attractive CPF usage and loan options. By comparing the benefits of ECs to traditional HDB flats, it becomes evident why these condominiums are a popular choice for those aspiring to elevate their living standards without compromising on affordability. In essence, Singapore ECs present a unique opportunity in the housing market that is both accessible and aspirational.